Interest rates rising have increased interest in the pension annuities market recently.

Looking at the best buy tables in the Times on Saturday 1st April, the best rate for a 60 year old is close to 6%.

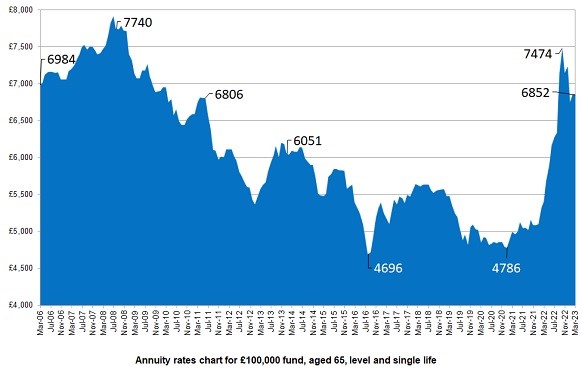

The below table is for 65 year olds representing the last 17 years:

Rates therefore appear to be in a good place and still higher than those some 13 years ago. Securing a high rate for a pension pot, or part of the pension pot, certainly to cover known expenditure, could be prudent for many clients. So, whilst many jumped onto the pension flexibility band wagon some years ago, (we all remember the Lamborghini speech!), the promise of certainty on income in the current volatile markets could initiate the need to seek financial advice for many clients.

The rates are 50% up on where they were back in 2016. Whilst no-one can predict whether they will be higher or lower in the next few years we can be sure that some would benefit from discussing and securing current rates for some of their pensions with their advisers in the short term.